- Introduction: The Future of Ethereum Staking

- What is Liquidity Mining?

- Rocket Pool: Ethereum’s Decentralized Staking Solution

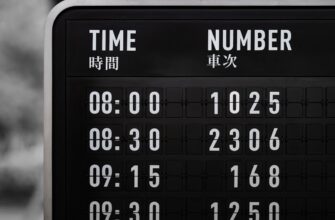

- How Liquidity Mining Ethereum on Rocket Pool Works in 2025

- Why Liquidity Mine ETH on Rocket Pool in 2025?

- Step-by-Step Guide: Liquidity Mining ETH via Rocket Pool

- Key Risks and Mitigation Strategies

- 2025 Outlook: Rocket Pool and Ethereum’s Evolution

- FAQ: Liquidity Mining Ethereum on Rocket Pool

Introduction: The Future of Ethereum Staking

As Ethereum continues evolving post-Merge, liquidity mining via Rocket Pool offers an innovative way to earn rewards while maintaining flexibility. By 2025, with Ethereum’s ecosystem maturing and Rocket Pool’s decentralized staking protocol gaining traction, liquidity mining ETH could become a cornerstone strategy for passive income. This guide explores how to leverage Rocket Pool’s rETH token for optimized returns, capital efficiency, and network participation in the coming years.

What is Liquidity Mining?

Liquidity mining (or yield farming) involves depositing crypto assets into DeFi protocols to earn rewards, typically in governance tokens or transaction fees. Unlike traditional staking, it provides:

- Instant liquidity via tokenized positions

- Higher yield potential through incentive programs

- Flexibility to exit positions without lock-up periods

Rocket Pool: Ethereum’s Decentralized Staking Solution

Rocket Pool is a permissionless staking protocol allowing users to stake ETH without running validators. Key features include:

- rETH Token: A liquid staking derivative representing staked ETH + rewards

- Node Operator Network: Decentralized infrastructure for validator management

- Lower Barriers: Stake any amount (no 32 ETH minimum)

By 2025, expect enhanced scalability and cross-chain integrations as Rocket Pool expands its ecosystem.

How Liquidity Mining Ethereum on Rocket Pool Works in 2025

The process involves converting ETH to rETH, then supplying it to DeFi platforms:

- Stake ETH via Rocket Pool to mint rETH

- Deposit rETH into supported liquidity pools (e.g., Uniswap, Balancer)

- Earn triple rewards: ETH staking yields + trading fees + protocol incentives

Projected 2025 innovations include automated yield optimizers and institutional-grade vaults for rETH.

Why Liquidity Mine ETH on Rocket Pool in 2025?

Five compelling advantages:

- Capital Efficiency: Use rETH as collateral while earning yields

- Enhanced Returns: Combine staking APY (estimated 4-6%) with liquidity mining bonuses

- Ethereum 2.0 Synergy: Benefit from post-upgrade scalability and fee reductions

- DeFi Integration: rETH’s growing utility across lending/borrowing platforms

- Risk Diversification: Avoid solo validator slashing risks

Step-by-Step Guide: Liquidity Mining ETH via Rocket Pool

- Acquire ETH from any exchange

- Connect wallet to Rocket Pool (e.g., MetaMask)

- Swap ETH for rETH (starts accruing rewards immediately)

- Choose a DeFi platform (e.g., Aave, Curve) supporting rETH pools

- Deposit rETH into selected liquidity pool

- Monitor rewards via dashboard and compound earnings

Key Risks and Mitigation Strategies

- Smart Contract Vulnerabilities: Use audited platforms only

- Impermanent Loss: Prefer stable pairings (e.g., rETH/ETH)

- Regulatory Shifts: Stay updated on crypto staking laws

- rETH Depeg Risk: Monitor oracle health and redemption rates

2025 Outlook: Rocket Pool and Ethereum’s Evolution

Anticipated developments:

- rETH becoming a DeFi reserve currency

- Layer-2 integrations reducing gas costs

- Advanced slashing insurance for node operators

- Increased institutional adoption via compliant wrappers

FAQ: Liquidity Mining Ethereum on Rocket Pool

Q: Is liquidity mining safer than solo staking?

A: It reduces technical risks but introduces DeFi-specific vulnerabilities. Diversification is key.

Q: What APY can I expect in 2025?

A: Projections suggest 8-12% combined yields (staking + liquidity rewards), varying by platform.

Q: Can I lose my staked ETH?

A: Not through Rocket Pool’s core protocol. Risks stem from DeFi exploits or extreme market volatility.

Q: How will Ethereum’s upgrades affect this strategy?

A: Proto-danksharding (EIP-4844) will lower L2 fees, boosting rETH’s utility and pool activity.

Q: Do I need technical skills to start?

A: No – Rocket Pool’s interface simplifies the process, though understanding DeFi basics is recommended.