- Why Dollar-Cost Averaging (DCA) is Perfect for Cardano Traders

- Configuring Your Bybit Account for 15-Minute Cardano DCA

- Adapting DCA for Cardano’s 15-Minute Volatility

- Risk Management Essentials for High-Frequency ADA DCA

- Why Bybit Excels for Cardano DCA Strategies

- Step-by-Step: Executing a 15-Minute Cardano DCA Cycle

- FAQ: Cardano DCA on Bybit in High Volatility

- Conclusion: Taming ADA Volatility with Precision

Why Dollar-Cost Averaging (DCA) is Perfect for Cardano Traders

Dollar-cost averaging (DCA) transforms volatility from a threat into an opportunity – especially for Cardano (ADA) traders navigating Bybit’s fast-paced markets. This systematic approach involves investing fixed amounts at regular intervals, smoothing out price fluctuations inherent to crypto’s 15-minute charts. For ADA, which frequently experiences 5-10% intraday swings, DCA on Bybit’s perpetual futures or spot markets allows you to:

- Reduce emotional decision-making during price spikes/dips

- Lower average entry costs during bearish cycles

- Automate accumulation during high volatility periods

- Leverage Bybit’s low 0.1% taker fees for frequent trades

Configuring Your Bybit Account for 15-Minute Cardano DCA

Optimize your Bybit setup before executing a high-frequency DCA strategy:

- Enable 2FA authentication for security

- Deposit stablecoins (USDT/USDC) to avoid ADA volatility

- Navigate to [Spot] or [Derivatives] > ADA/USDT pair

- Set chart timeframe to 15 minutes (click “15m” in top toolbar)

- Activate Bybit’s “Recurring Buy” feature for automated execution

Adapting DCA for Cardano’s 15-Minute Volatility

Standard DCA requires tweaks for hyper-short timeframes. Implement these adjustments:

- Position Sizing: Allocate 0.5-1% of capital per trade to withstand 30%+ ADA swings

- Volatility Triggers: Execute buys when 15m RSI drops below 35 (oversold) or Bollinger Bands widen by 15%

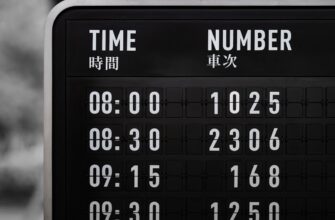

- Time Optimization: Schedule trades at 00/15/30/45 minute marks to align with candle closes

- Circuit Breakers: Pause DCA if ADA price drops 8% below VWAP within one candle

Risk Management Essentials for High-Frequency ADA DCA

Protect your capital with these non-negotiables:

- Set stop-loss orders at 3x your average 15m candle range

- Diversify entry points across support levels (e.g., $0.45, $0.42, $0.39)

- Never allocate more than 20% of portfolio to short-term DCA

- Monitor Cardano development updates that may trigger volatility

Why Bybit Excels for Cardano DCA Strategies

Bybit’s infrastructure provides distinct advantages for 15-minute ADA DCA:

- 99.99% uptime during high volatility events

- 0% maker fees on spot DCA orders

- Real-time ADA liquidation heatmaps to avoid crowded zones

- API integration for algorithmic DCA execution

Step-by-Step: Executing a 15-Minute Cardano DCA Cycle

- Analyze ADA’s 15m chart for prevailing trend (use EMA 50/200 crossover)

- Calculate position size: (Account Balance × 0.01) / 4 (for hourly cycles)

- Place limit orders 0.5% below current bid during downtrends

- Set take-profit at 3:1 reward ratio based on ATR(14) indicator

- Review performance weekly; adjust parameters if drawdown exceeds 5%

FAQ: Cardano DCA on Bybit in High Volatility

Q: How many DCA entries should I make daily on 15m charts?

A: 4-6 entries (every 2-4 hours) balances opportunity capture with risk control. Avoid overtrading during sideways markets.

Q: Can I use leverage with this DCA strategy?

A: Not recommended. High volatility + leverage + short timeframes = liquidation risk. Use spot markets only.

Q: What’s the optimal DCA duration for Cardano?

A: 6-8 weeks per campaign aligns with typical ADA volatility cycles. Reassess fundamentals quarterly.

Q: How do I track DCA performance on Bybit?

A: Use Bybit’s “Trade History” export combined with TradingView’s custom DCA calculator scripts.

Conclusion: Taming ADA Volatility with Precision

Mastering Cardano DCA on Bybit’s 15-minute charts transforms market chaos into calculated opportunity. By automating entries during dips, sizing positions for volatility, and leveraging Bybit’s robust infrastructure, you systematically accumulate ADA while neutralizing emotional trading. Remember: consistency beats timing. Start small with $10-20/test cycle, refine your parameters, and scale as you conquer Cardano’s thrilling volatility waves.